- Joined

- Mar 6, 2015

Once more, you ALWAYS had to pay those taxes. If you weren't paying them, you were breaking the law.

By law, a consumer is only required to pay sales taxes if they live in a state where the business has a warehouse. Federal taxes are factored into the price already when the business purchases the product from the distributor. I sold computer parts for 2 years and did my own federal and state business taxes. So yeah.

Newegg for i7-5930k

Subtotal: $579.99

Sales Tax: $40.81

Shipping: $2.99 (Super Eggsaver shipping)

TOTAL = $623.79

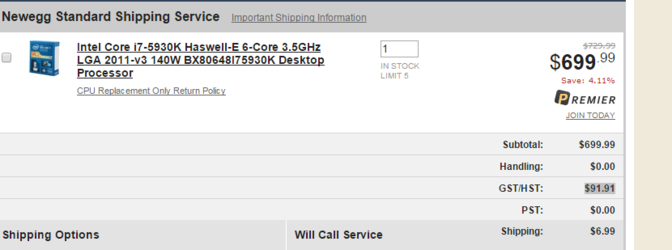

NCIX for i7-5930k

Shipping: $11.99

Subtotal: $577.98

No Sales Tax (Outside California): $0.00

YOUR TOTAL: USD $577.98

$45.81 difference!